Shell company

A shell company or corporation is one that does not run any significant active business operation or hold assets, they are a front for a company in a certain location. They are not in themselves illegal and are commonly set-up in locations to benefit from tax, employment or other laws in a certain jurisdiction, one that is not the same as their location of their primary active business. This mechanism is sometimes referred to as offshoring because these companies are registered offshore from the main activity of the business, or as ringfencing because it helps protect an entity from certain risks most often legal tax risks or the avoidance of them but sometimes also money laundering.

Shell companies are similar in their nature to special purpose vehicles (SPV) for building development in that they act as a second entity that allows risk to be drawn away from the main company or funder, for instance in the case of a large development. They differ from SPVs because they generally do not hold any assets and are merely an empty 'shell' of a company used to reduce financial risk for the parent company. SPVs often serve the same purpose as a shell company in terms of risk allocation but are more likely to have assets associated with them, for example a new development, land or a project associated risks.

See also article Special purpose vehicles SPV for building development

In the UK HM Revenue & Customs Company Taxation Manual CTM06610 (Change of Ownership: Shell Companies) refers to shell companies as being companies which:

- 'is not carrying on a trade'

- 'is not a company with an investment business; and'

- 'is not carrying on a UK property business.'

In broad terms the rules associated with this prevent certain reliefs for non-trading debits and losses (CTM06620) where there is a Shell Company which undergoes a change of ownership as defined under CTA10/S719 (CTM06340). Where the rules apply, they treat the actual accounting period in which the change of ownership took place as two separate notional accounting periods, the first ending with the date of change and the second consisting of the remainder of the period. The non-trading amounts for the actual period are then apportioned between the two notional periods.

[edit] Related articles on Designing Buildings

- Business model.

- Company acquisitions in construction.

- Consortium.

- Construction loan.

- Construction organisation design.

- Construction organisations and strategy.

- Joint venture.

- Leaseback.

- Midland Expressway Ltd v Carillion Construction Ltd & Others.

- Partnering and joint ventures.

- Partnership.

- Ringfencing.

- Special purpose vehicles.

- Types of construction organisations.

Featured articles and news

The context, schemes, standards, roles and relevance of the Building Safety Act.

Retrofit 25 – What's Stopping Us?

Exhibition Opens at The Building Centre.

Types of work to existing buildings

A simple circular economy wiki breakdown with further links.

A threat to the creativity that makes London special.

How can digital twins boost profitability within construction?

The smart construction dashboard, as-built data and site changes forming an accurate digital twin.

Unlocking surplus public defence land and more to speed up the delivery of housing.

The Planning and Infrastructure Bill

An outline of the bill with a mix of reactions on potential impacts from IHBC, CIEEM, CIC, ACE and EIC.

Farnborough College Unveils its Half-house for Sustainable Construction Training.

Spring Statement 2025 with reactions from industry

Confirming previously announced funding, and welfare changes amid adjusted growth forecast.

Scottish Government responds to Grenfell report

As fund for unsafe cladding assessments is launched.

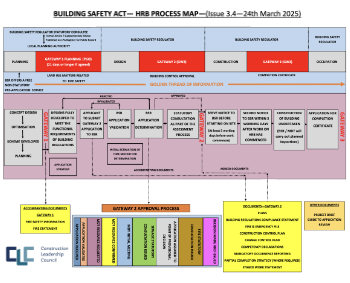

CLC and BSR process map for HRB approvals

One of the initial outputs of their weekly BSR meetings.

Architects Academy at an insulation manufacturing facility

Programme of technical engagement for aspiring designers.

Building Safety Levy technical consultation response

Details of the planned levy now due in 2026.

Great British Energy install solar on school and NHS sites

200 schools and 200 NHS sites to get solar systems, as first project of the newly formed government initiative.

600 million for 60,000 more skilled construction workers

Announced by Treasury ahead of the Spring Statement.

The restoration of the novelist’s birthplace in Eastwood.

Life Critical Fire Safety External Wall System LCFS EWS

Breaking down what is meant by this now often used term.

PAC report on the Remediation of Dangerous Cladding

Recommendations on workforce, transparency, support, insurance, funding, fraud and mismanagement.

New towns, expanded settlements and housing delivery

Modular inquiry asks if new towns and expanded settlements are an effective means of delivering housing.